Extract from the Government's statistics and opinion

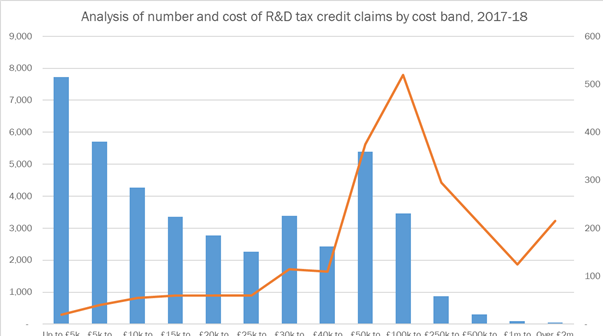

The two largest cost bands in terms of number are claims up to £5k and claims between £5k and £10k. However, these represent the two smallest bands in terms of claim size. The removal of the minimum R&D expenditure of £10,000 made these small claims allowable from 1 April 2012.

We believe that the huge growth in the number of small SME claims in the last 10 years has been largely driven by aggressive R&D Tax Relief Claim 'ambulance chasers'. These firms operate in a similar fashion to PPI chasers employing a shotgun, robocall approach to win potential clients and then with little regard for the true R&D eligibility of the work carried out. This has resulted in a flood of small R&D Tax Relief claims by new entrants.

Why is this a problem?

Smaller claims are less likely to include eligible R&D and HMRC doesn't have the time or seem to have the motivation to challenge them, so a feeling is building that R&D is simply a government hand out, fill in a form and receive some welcome cash.

We know from experience in relation to many potential clients we have turned down, that smaller firms with less established R&D processes carry out a lower propensity of R&D compared to larger, more established companies.

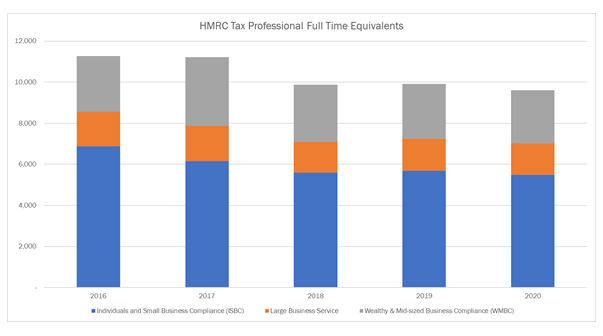

The bottom line here is that with a higher number of claims and the same, or reduced workforce, HMRC has less opportunity to fully review R&D Tax Relief claims, which should be a concern for the public accounts committee and you as a taxpayer.

Statistics published by the Government and with the Crown reproduction permission.

Claims data

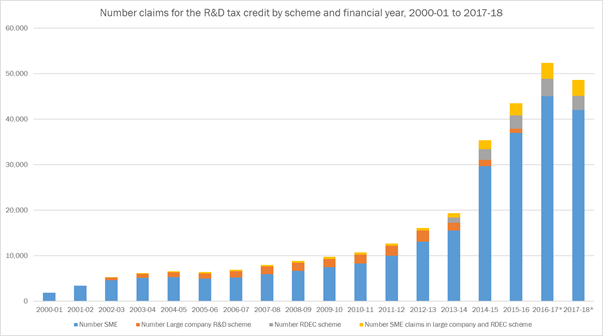

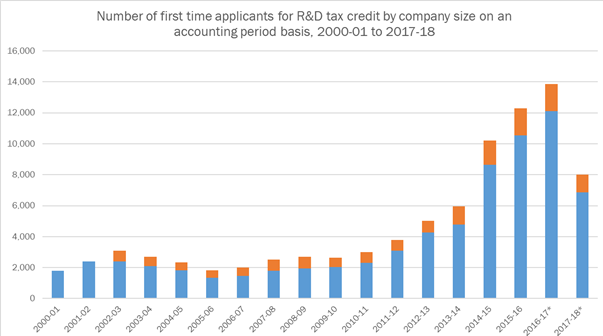

The number of R&D Tax Relief claims has continued to rise since the scheme's inception in 2000. R&D Tax Relief is popular and continues to rise in popularity - over 300,000 claims have been made since the scheme was launched.

* Indicates incomplete data related to claims still being processed.

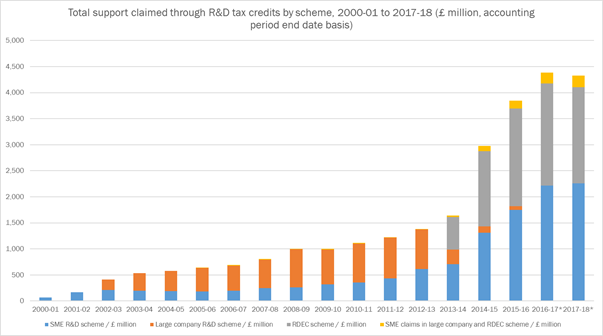

This is matched by an increase in the total support provided through the R&D Tax Relief scheme. Over £26.9bn in tax relief has been claimed over the life of the scheme.

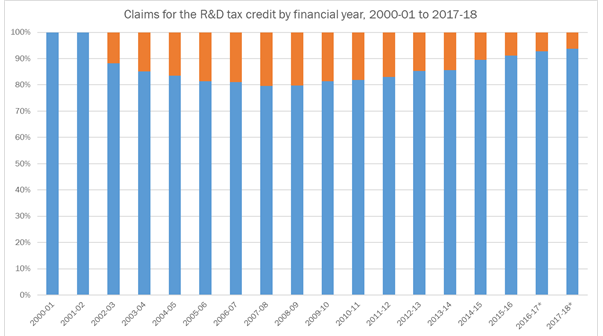

Over the last 10 years, there has been a shift in the number of claims made by SMEs compared to the number made by Large Companies. For the most recent period we have data available, 2017-2018, 94% of claims were made by SMEs, compared to a low of 80% in 2008-2009.

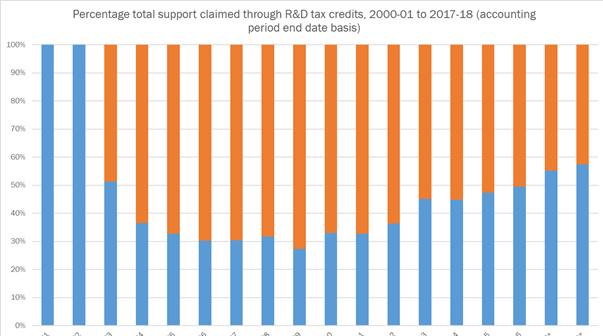

Over the last decade, there has also been a huge shift in the total support provided by the R&D Tax Relief schemes from Large Companies to SMEs. For 2017-2018, 57% of support went to SMEs, compared to a low of 27% in 2008-09.

"The removal of the requirement for a minimum R&D expenditure of £10,000 has meant that more companies are eligible to apply for the relief. In the same year the PAYE cap was removed, opening up the scheme to more users. There have also been increases in the SME enhanced expenditure rate, including a rise from 125% to 130% in 2015-16. These changes, together with an increase in the SME payable tax credit rate from 11% in 2012-13 to 14.5% in 2014-15, have made the scheme more attractive."

MMP believe these are strong drivers, but they don't give the whole picture. We think there is another reason. The rise of R&D Tax Relief Claim chasers, much akin to 'PPI' chasers.

The Office of National Statistics has only recently made data available breaking down R&D Tax Relief claim sizes and numbers into different bands. This is hugely illuminating.

The two largest cost bands in terms of number are claims up to £5k and claims between £5k and £10k. However, these represent the two smallest bands in terms of claim size. The removal of the minimum R&D expenditure of £10,000 made these small claims allowable from 1 April 2012.

We believe that the huge growth in the number of small SME claims in the last 10 years has been largely driven by aggressive R&D Tax Relief Claim 'ambulance chasers'. These firms operate in a similar fashion to PPI chasers employing a shotgun, robocall approach to win potential clients and with little regard for the true R&D eligibility of the work carried out. This has resulted in a flood of small R&D Tax Relief claims by new entrants.

Why is this a problem?

Smaller claims are less likely to include eligible R&D.

- We know from experience in relation to many potential clients we have turned down, that smaller firms with less established R&D processes carry out a lower propensity of R&D compared to larger, more established companies.

Smaller claims are more likely to fly under HMRC's radar

HMRC is processing claims more "efficiently"

Between 2016 and 2020 the number of Tax Professionals which HMRC allocates to Small Business Compliance (ISBC), Large Business Service (LBS) and Wealthy & Mid-sized Business Compliance (WMBC) departments has shrunk by 14.8%. This doesn't determine how HMRC decides to internally allocate Tax Professional resources to reviewing R&D Tax Relief claims, but it does provide a strong indicator of shrinking departments, with less resource available.

HMRC has specialist R&D units which were setup to exclusively process R&D Tax Relief claims. These units were originally structured to process postcodes relevant to their geographical area. This reflected an era between 2000-2010 when the number of R&D Tax Claims each year was more manageable and the number of new, first time applicants was consistent.

From 2011 onwards the number of claims which these specialist units had to process accelerated. When VGTR and Patent Box regimes were introduced, the burden fell on these specialist units to process these claims also. In addition, HMRC used to have five of these specialist units in Croydon, Leicester, Manchester, Portsmouth and Cardiff. HMRC closed the Cardiff and Croydon R&D Specialist units, increasing the burden on the remaining units.

In February 2017, HMRC changed its phone numbers and emails for the specialist units so you could no longer contact them directly. Instead, a pooled email and phone access was provided. This reflected claims no longer being processed by a specific specialist unit, but instead being placed into a central pool which all three remaining units were responsible for. This was to share workload across the remaining units.

However, the yearly number of R&D Tax Relief claims continued to grow, and these specialist units became significantly under resourced. In 2018, HMRC hit a crisis point and amassed a massive six-month backlog of unprocessed claims. So, something had to give.

To give the inspectors the opportunity to process this huge backlog, HMRC decided to remove the ability to email or phone any of the inspectors or specialist units directly, but instead the only way to access information about the progress of an R&D Tax Relief claim was by calling the General Corporation Tax helpline.

HMRC was eventually successful in clearing this backlog, but this marked a permanent change in terms of contacting the specialist units. As of March 2021, it is still not possible to speak to or email any of the specialist units or inspectors directly. The result is a black box.

HMRC has also made efforts to standardise the information which companies submit for their R&D Tax Relief claims to accompany the CT600 and tax computations.

During 2019 HMRC introduced an online form which can be used to submit SME R&D Tax Relief claims and another form to submit RDEC claims. These forms demand that Companies stick to a strict character limit for each pre-determined section meaning the level of information is much restricted, making the officer's evaluation of eligibility more difficult.

For information about how you can switch providers to MMP, you can contact one of our advisors who will be pleased to review your existing claim and provide an honest fee-free opinion as to its eligibility, get in touch or to speak directly and confidentially to a consultant, call us.

Back to Part 1 of David's analysis where he gives his opinion on the state of the R&D claims industry.

David is one of the founding Directors of MMP Tax.